- Communications

- News

- Press Release

Contact:

Bob Young

510-251-9470 |

For Release:

November 29, 2023

|

DIR Announces 2024 California Workers' Comp User Funding Assessment Rates

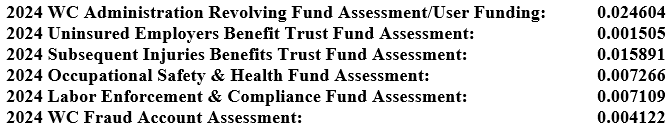

Oakland, CA -- The California Department of Industrial Relations (DIR) has issued the 2024 assessments that workers’ compensation insurers are required to collect from policyholders to cover the budget of the state Division of Workers’ Compensation (DWC) and five related programs set up by state lawmakers. Insurers should apply the following rates against their policyholders’ estimated annual assessable premium for policies incepting January 1, 2024 through December 31, 2024:

State law also requires insurers to advance the money on behalf of their policyholders (the first installment is due on or before January 1, 2024; the balance is due on or before April 1, 2024), then recoup the funds via surcharges and assessments on all workers’ compensation policies with 2024 inception dates. Assessment methodologies are noted in a DIR memo issued this week. The DIR memo to insurers notes that for single carriers that were not part of an insurer group that reported data to the WCIRB on an individual company basis for 2022, “Total California Direct Written Premium for assessment purposes is the amount reported for calendar year 2022 to the WCIRB, which reflects the premiums charged to policyholders with the exception that it excludes the impact of deductible credits, retrospective rating adjustments, and policyholder dividends.” For insurers that were part of an insurer reporting group that reported data to the WCIRB for 2022, “Total California Direct Written Premium for assessment purposes is the product of (a) the total 2022 written premium reported to the WCIRB on the aforementioned basis and (b) the ratio of your 2022 California written premium as reported in the 2022 Statutory Annual Statement (these amounts include the effect of deductible credits and retrospective rating adjustments) to the total 2022 Statutory Annual Statement of California written premium reported for your insurer group as a whole.”

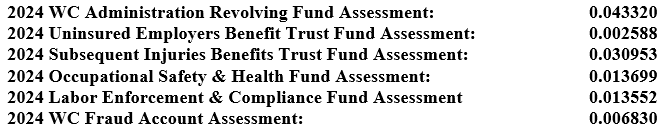

To cover their share of the 2024 assessments, self-insured and California legally uninsured employers must apply the following rates against the total amount of workers’ compensation indemnity they paid:

More details for insurers are in the memo that DIR posted under “What’s New” at https://www.dir.ca.gov/dwc/ and more details for self-insurers are in the memo that DIR posted under “What’s New” at https://www.dir.ca.gov/osip/. The state is mailing the memos along with invoices for each company’s share of the assessments and surcharges to California workers’ comp insurers, self-insured employers and legally uninsured employers. Insurers with questions about the 2024 surcharges and assessments may email them to DIRDWC Assessment@dir.ca.gov. Self-insureds or California legally uninsured employers may call the Office of Self-Insurance Plans in Sacramento at (916) 464-7000.

* * * * *